If your property is sold at auction, and the highest bid is not sufficient enough to cover the full outstanding balance, the bank will go after you for what's called a defficiency balance. On top of that a Foreclosure will be added to your record. Having a Foreclosure on your credit report will prevent you from purchasing another home for a period 7-10 years.

There are a few ways to handle Foreclosure. Try to work out a loan modification with your bank. If you are employed and can show enough income on your paystubs to prove to the bank your ability to mainain the payments, that's your best shot.

If you don't have a stable income, you can try Deed in Lieu or Sell the property the traditional way. With Deed in Lieu you simply turn your keys to the bank, and they remove the mortgage from your record. Of course the property must have equity in it and cannot have any additional liens and judgments on title. If you have enough equity in the property you might try to sell it using a real estate agent. We can refer you to a professional if you don't have one.

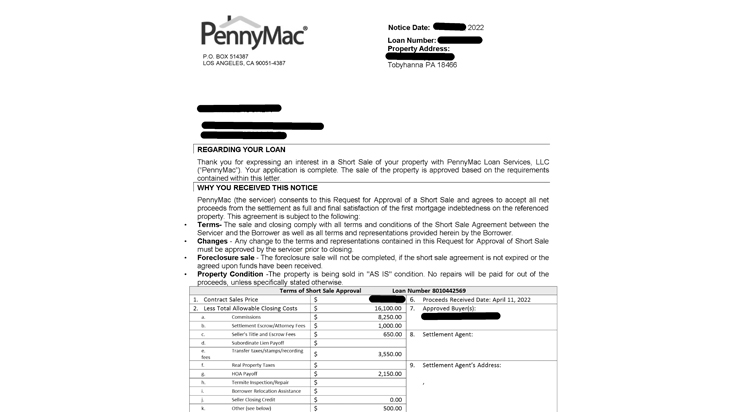

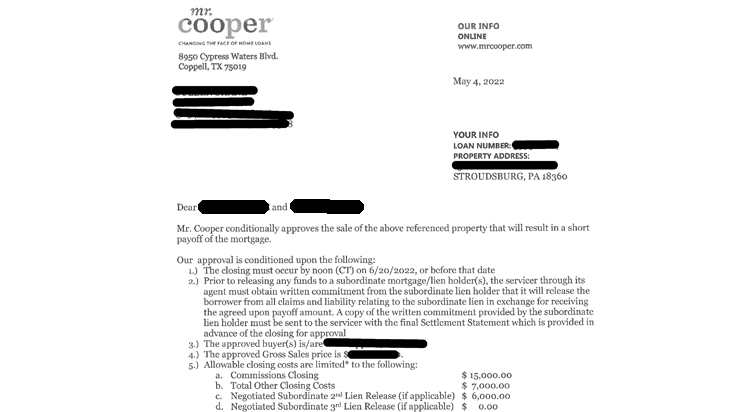

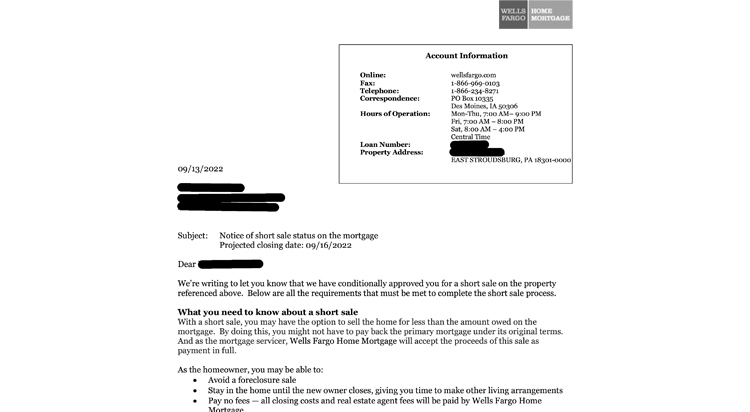

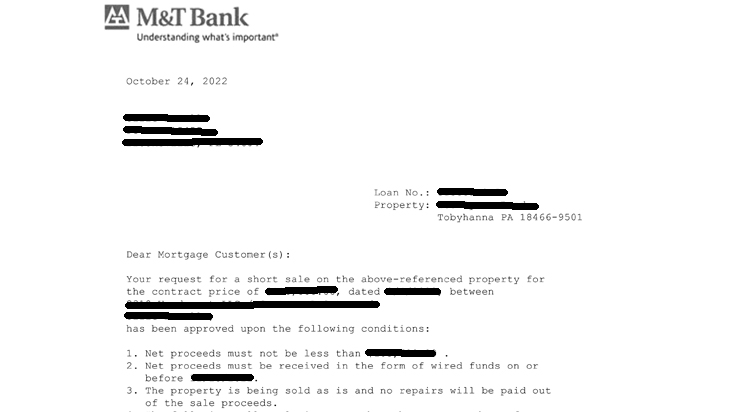

If previous steps did not work for you, then your option is a Short Sale. Yes, you will have to walk away from the property, but you will be debt free, and have an ability to purchase another home within the next 2 years. With a Short Sale the bank accepts our terms to sell the property for less amount than what is owed on the loan. In addition to this, all other liens and judgment are satisfied prior to the sale. Shot Sale is not a quick process, it usually takes 2-6 months, which makes your the bank cancel or postpone your upcoming Auction.

Each bank has it's own set of documents required for the process. We will provide the right ones, but you'll also need to provide your personal information, such as: